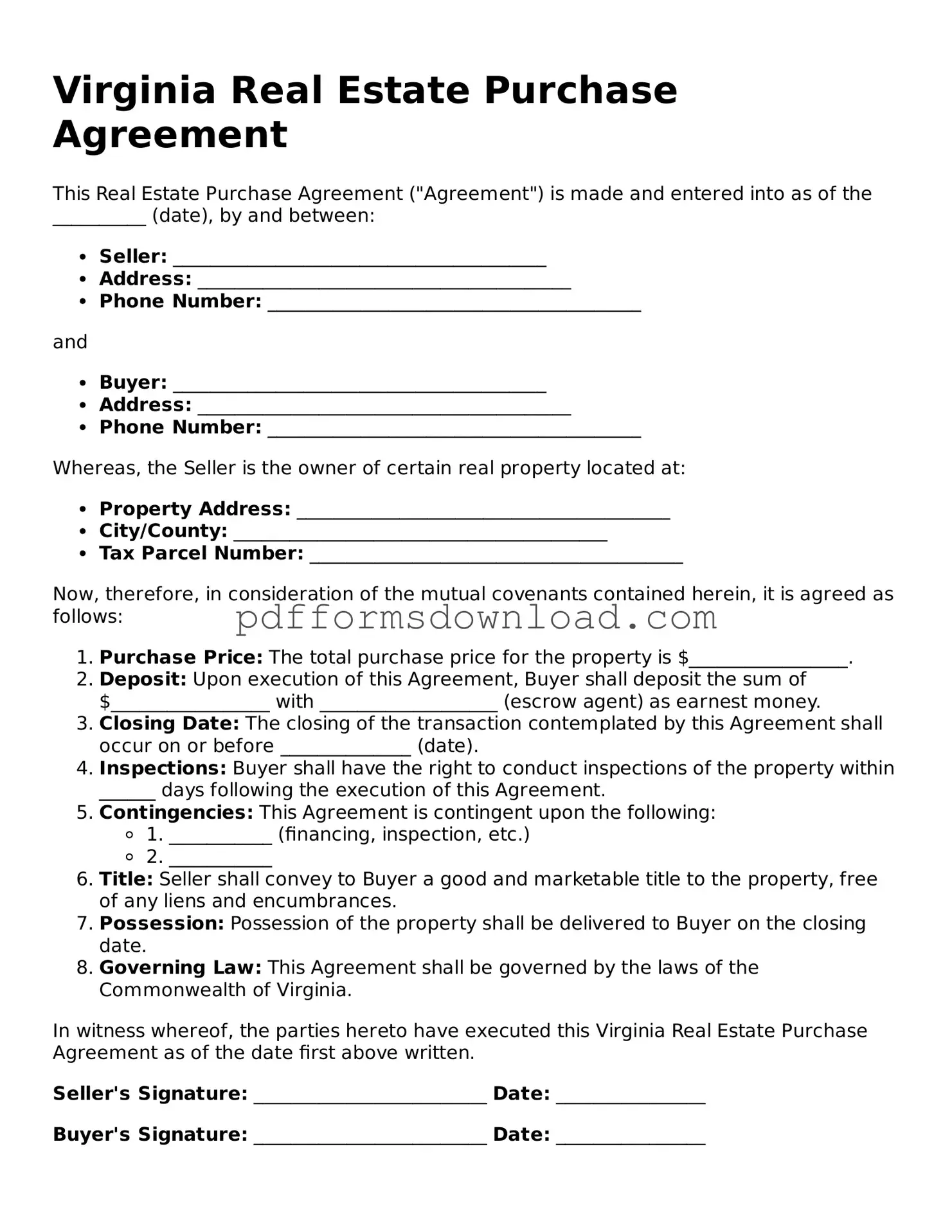

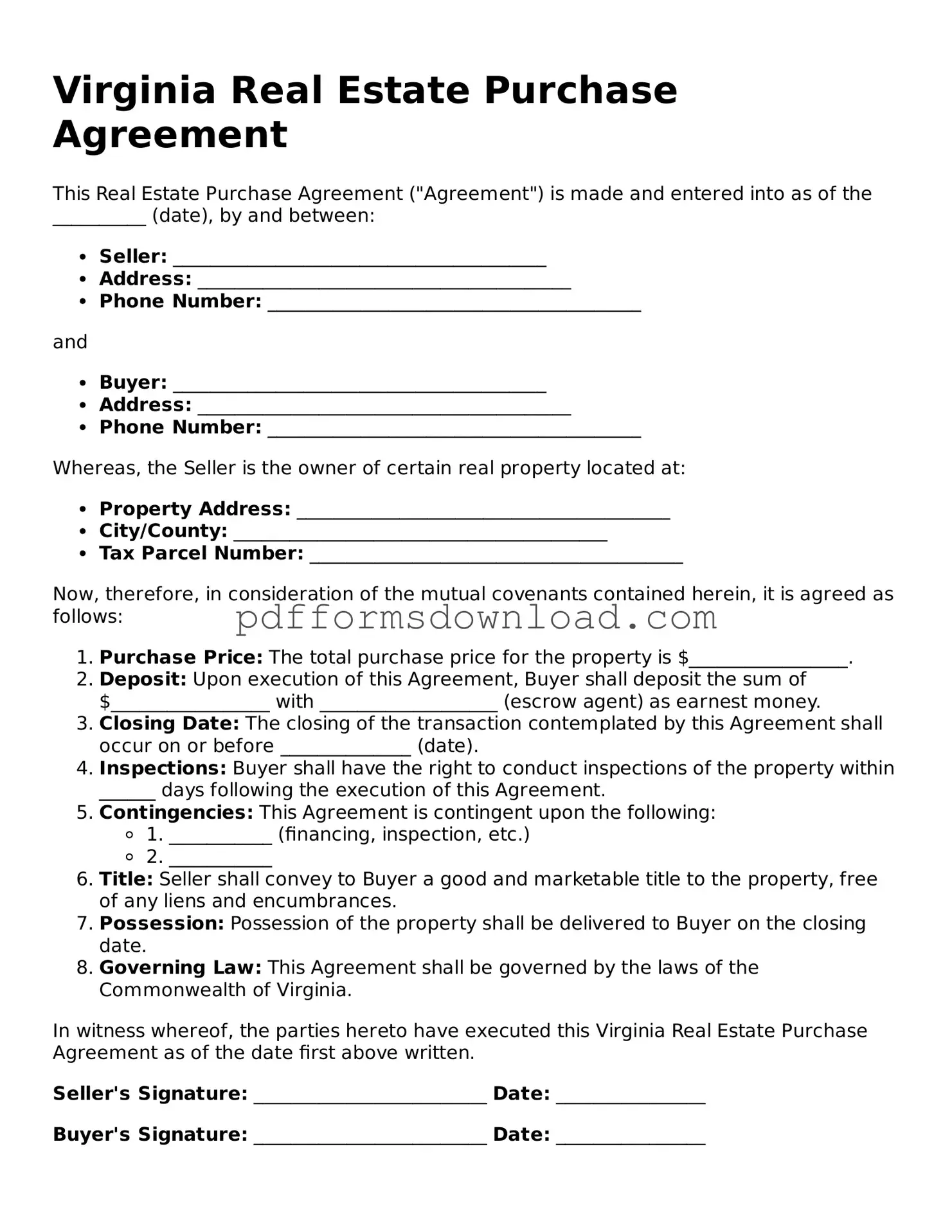

What is a Virginia Real Estate Purchase Agreement?

A Virginia Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. It includes essential details such as the purchase price, property description, and any contingencies that must be met for the sale to proceed.

What information is required in the agreement?

The agreement must include the names of the buyer and seller, the property address, the purchase price, the earnest money deposit, and any contingencies such as financing or inspections. It may also specify closing dates and any included fixtures or personal property.

What are contingencies, and why are they important?

Contingencies are conditions that must be met for the sale to be finalized. Common contingencies include financing approval, satisfactory home inspections, and the sale of the buyer's current home. They protect both parties by allowing the buyer to back out if certain conditions aren't met.

How does the earnest money deposit work?

The earnest money deposit is a sum of money the buyer submits with the purchase agreement to demonstrate serious intent. This deposit is typically held in escrow and applied to the purchase price at closing. If the buyer backs out without a valid reason, the seller may retain the deposit.

Can the purchase agreement be modified after signing?

Yes, the purchase agreement can be modified if both the buyer and seller agree to the changes. Any modifications should be documented in writing and signed by both parties to ensure clarity and enforceability.

What happens if the buyer or seller breaches the agreement?

If either party fails to fulfill their obligations under the agreement, it is considered a breach. The non-breaching party may have the right to seek damages or specific performance, which means they can ask the court to enforce the terms of the agreement.

Is it necessary to have a real estate agent to use this agreement?

No, it is not necessary to have a real estate agent to use a Virginia Real Estate Purchase Agreement. However, having an agent can provide valuable guidance and help navigate the complexities of the transaction, ensuring that all legal requirements are met.

How long is the agreement valid?

The validity of the agreement typically depends on the terms specified within it. Most agreements include a timeframe for closing, which can range from a few weeks to several months. If the closing does not occur within the agreed timeframe, the agreement may become void unless extended by mutual consent.

Where can I obtain a Virginia Real Estate Purchase Agreement form?

Virginia Real Estate Purchase Agreement forms can be obtained from various sources, including real estate agencies, legal document providers, or online legal resources. It is essential to ensure that the form is up-to-date and compliant with Virginia laws.