What is a Virginia Transfer-on-Death Deed?

A Virginia Transfer-on-Death Deed is a legal document that allows an individual to transfer real estate to one or more beneficiaries upon their death. This type of deed is effective immediately upon execution but does not transfer ownership until the owner passes away. It provides a way to avoid probate, simplifying the process for heirs.

Who can create a Transfer-on-Death Deed in Virginia?

Any individual who owns real estate in Virginia can create a Transfer-on-Death Deed. The owner must be of legal age and mentally competent to make such a decision. Additionally, the deed must be properly executed according to Virginia law to be valid.

What are the benefits of using a Transfer-on-Death Deed?

The primary benefit of a Transfer-on-Death Deed is that it allows for the direct transfer of property without going through probate. This can save time and money for the beneficiaries. Additionally, the deed can be revoked or altered at any time before the owner's death, providing flexibility for the owner.

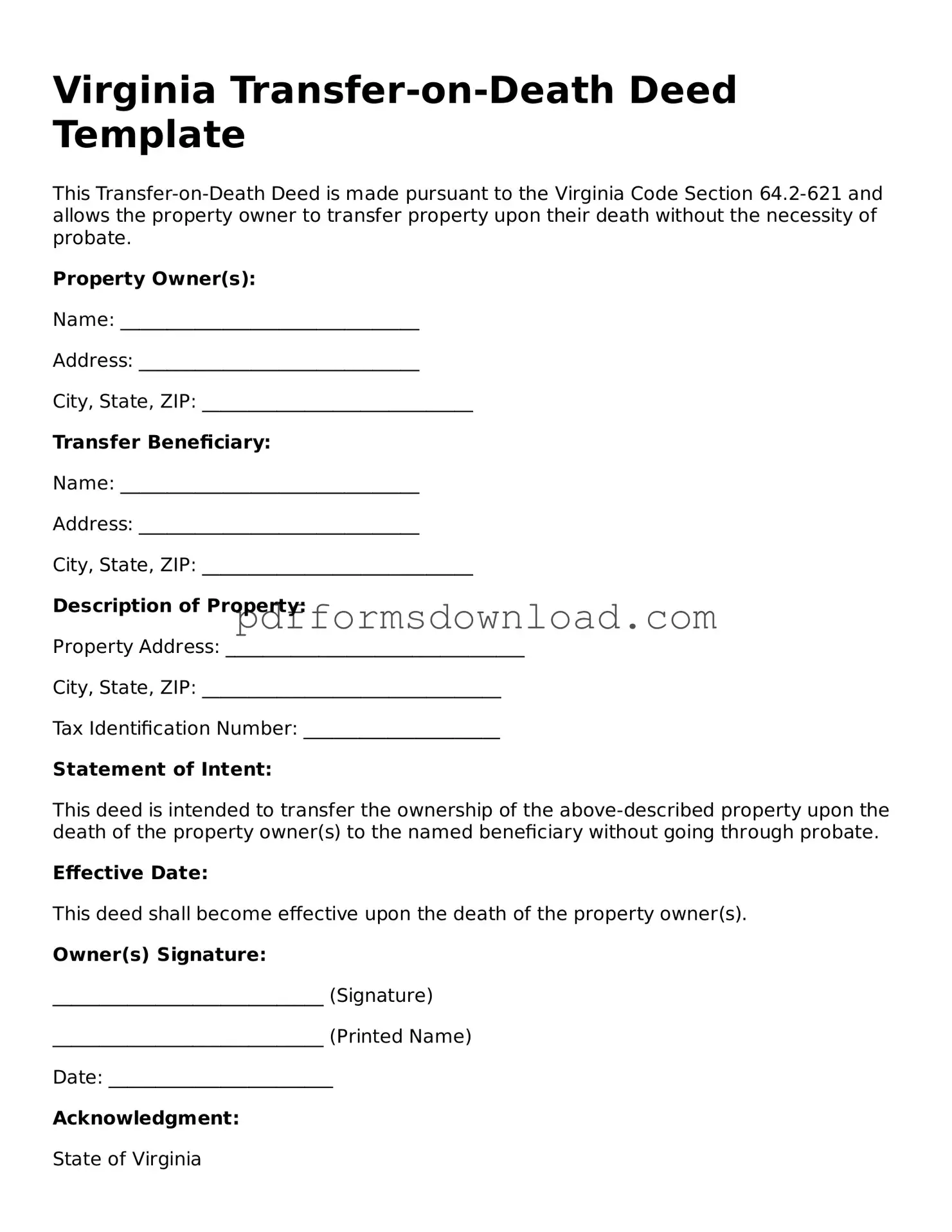

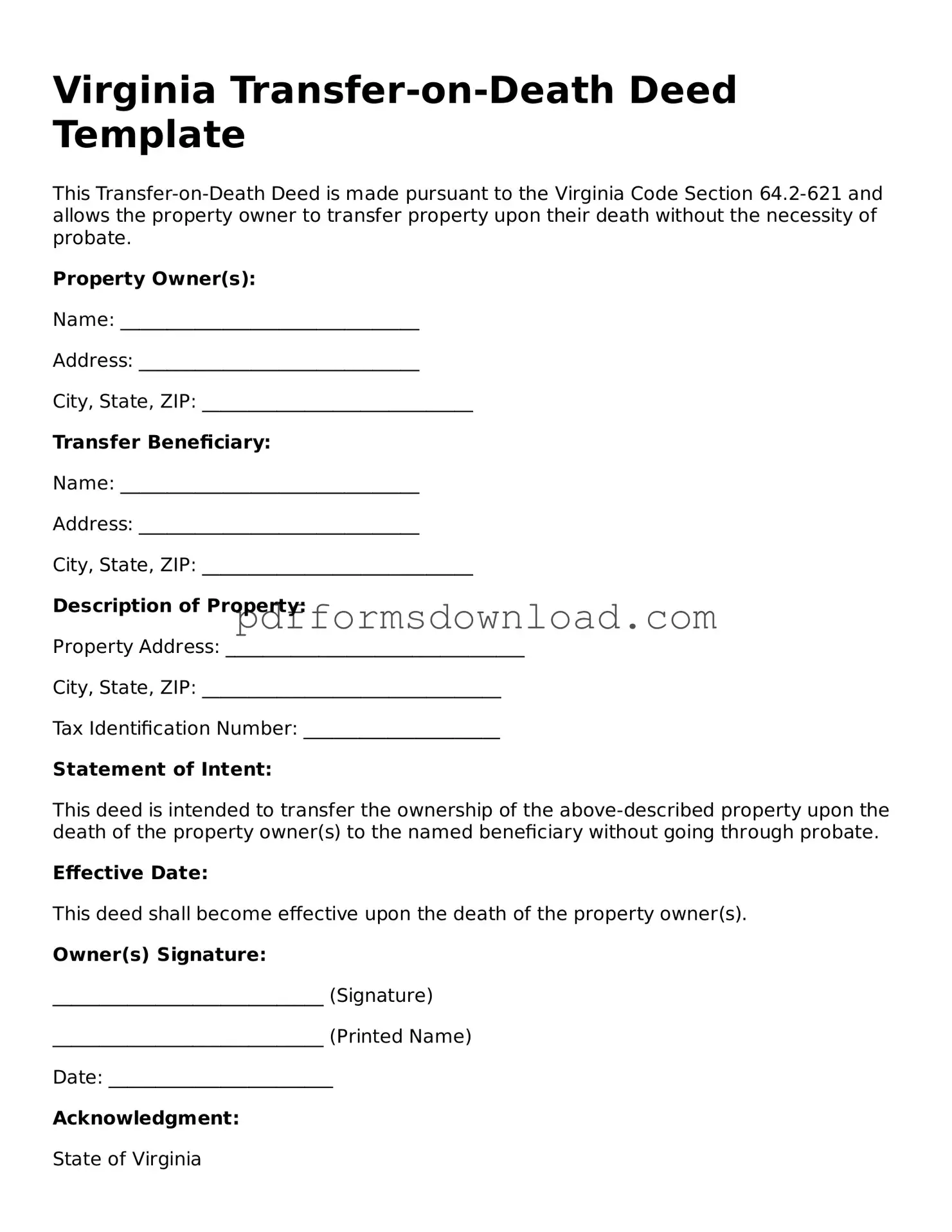

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, the owner must fill out the appropriate form, which includes details about the property and the beneficiaries. The deed must then be signed in the presence of a notary public. Finally, it must be recorded with the local land records office in the jurisdiction where the property is located.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To revoke the deed, you must execute a new deed that explicitly states the revocation or file a formal revocation document with the local land records office. It is advisable to notify the beneficiaries of any changes to avoid confusion later.

What happens if the beneficiary predeceases the owner?

If a beneficiary named in the Transfer-on-Death Deed dies before the owner, the property will not automatically transfer to that beneficiary's heirs. Instead, the deed will typically be void for that beneficiary. The owner may choose to name a new beneficiary or allow the property to pass according to their will or state law if no new beneficiary is designated.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. However, the property may be subject to estate taxes upon the owner's death, depending on the total value of the estate. Beneficiaries may also face capital gains taxes if they sell the property after inheriting it. It is advisable to consult a tax professional for specific guidance.

Can a Transfer-on-Death Deed be used for all types of property?

A Transfer-on-Death Deed can only be used for real estate. It does not apply to personal property, such as bank accounts or vehicles. For those assets, different estate planning tools, such as wills or trusts, may be more appropriate. Always consider consulting with an estate planning attorney to determine the best approach for your situation.