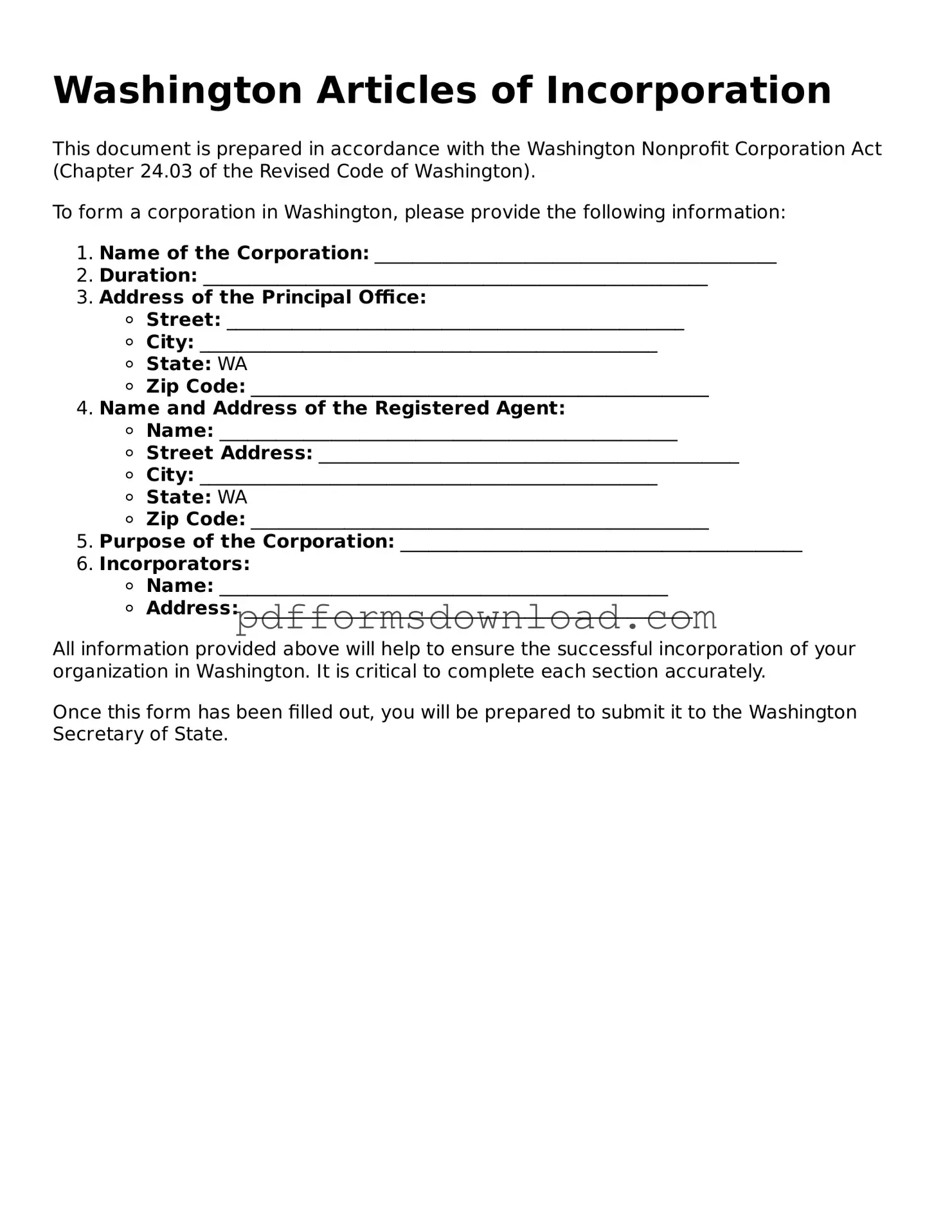

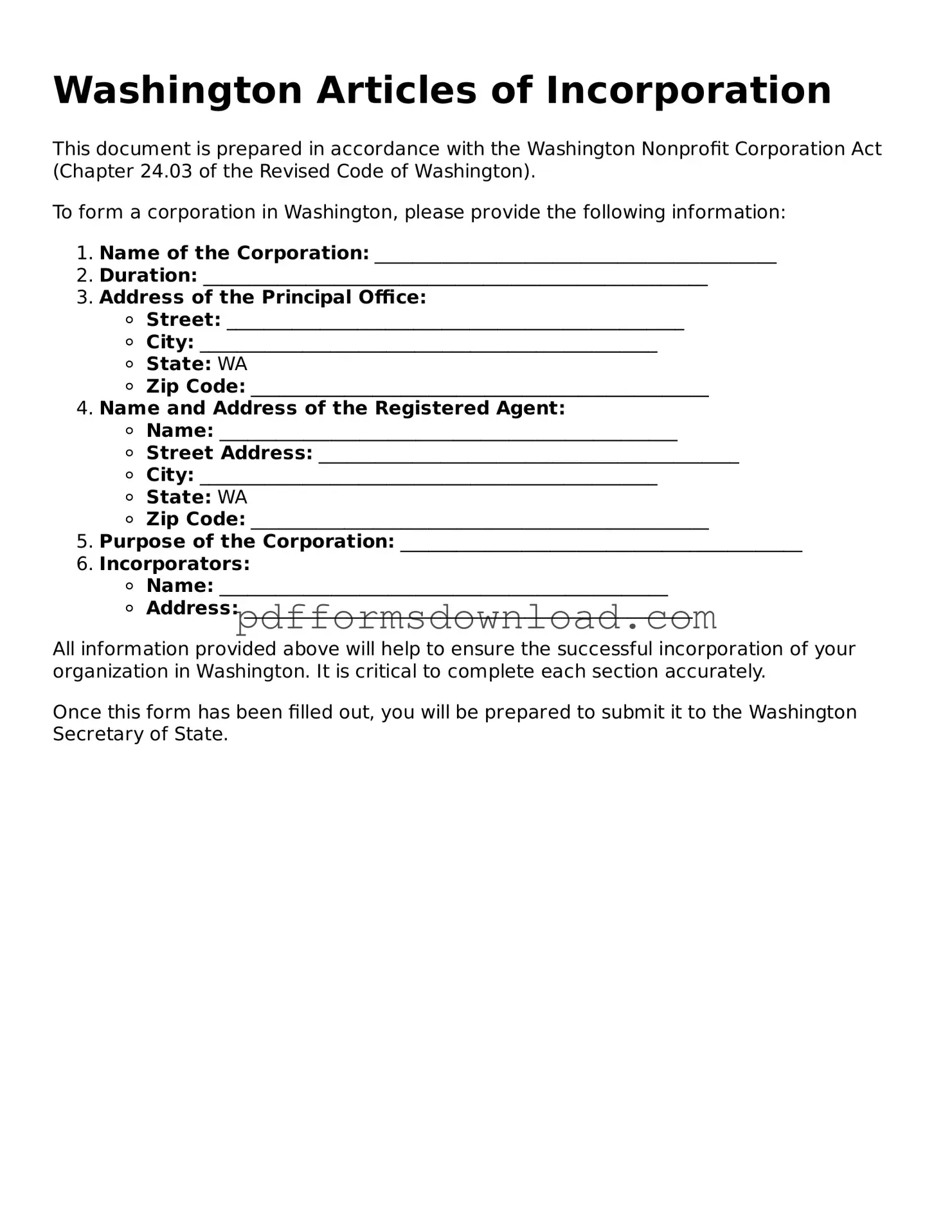

What are the Articles of Incorporation in Washington State?

The Articles of Incorporation is a legal document required to establish a corporation in Washington State. This document outlines essential details about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document with the Washington Secretary of State is the first step in creating a corporation and provides the business with legal recognition and protections under state law.

What information do I need to include in the Articles of Incorporation?

When completing the Articles of Incorporation, you will need to provide several key pieces of information. This includes the corporation's name, which must be unique and not misleading. You must also state the purpose of the corporation, identify a registered agent who will receive legal documents on behalf of the corporation, and specify the number of shares the corporation is authorized to issue. Additionally, you may include details about the incorporators and the corporation's duration, whether it is perpetual or for a specified period.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in Washington, you can submit the form online through the Washington Secretary of State’s website or send a paper form by mail. If filing online, you will need to create an account or log in. The filing fee must be paid at the time of submission. Make sure to double-check all information for accuracy before submitting, as errors can lead to delays or rejection of your application.

What is the cost to file the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Washington State is typically around $200 if filed online and $180 if filed by mail. However, fees can change, so it is advisable to check the Washington Secretary of State’s website for the most current fee structure. Additional fees may apply if you choose expedited processing or if you are filing for specific types of corporations.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Typically, online filings are processed faster, often within a few business days. Paper filings may take longer, sometimes up to several weeks. If you require expedited processing, you can request it for an additional fee, which will shorten the wait time significantly.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you will receive a confirmation from the Washington Secretary of State. At this point, your corporation is officially recognized. You should then obtain an Employer Identification Number (EIN) from the IRS, set up a corporate bank account, and comply with any local licensing requirements. Additionally, it is important to maintain good standing by filing annual reports and paying any necessary fees on time.