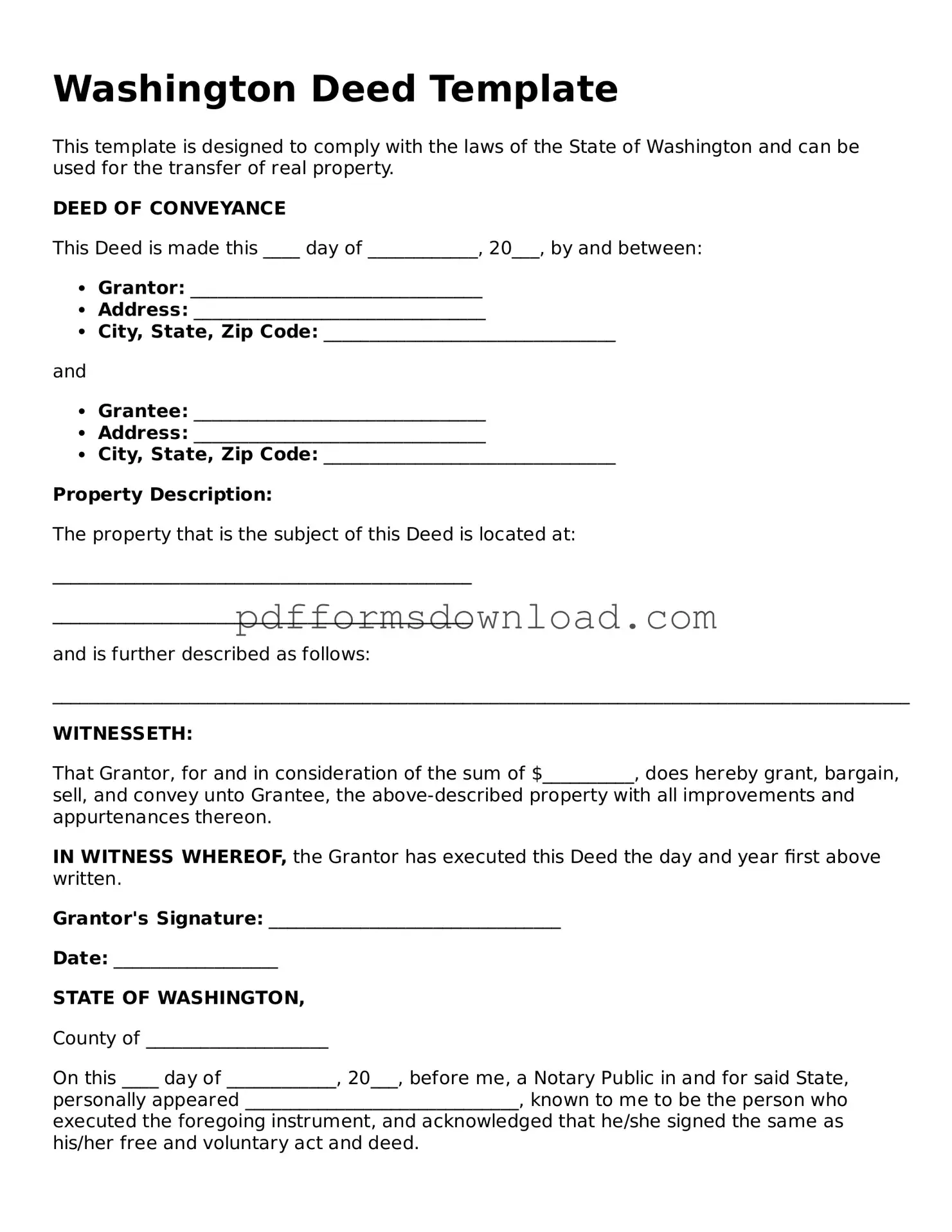

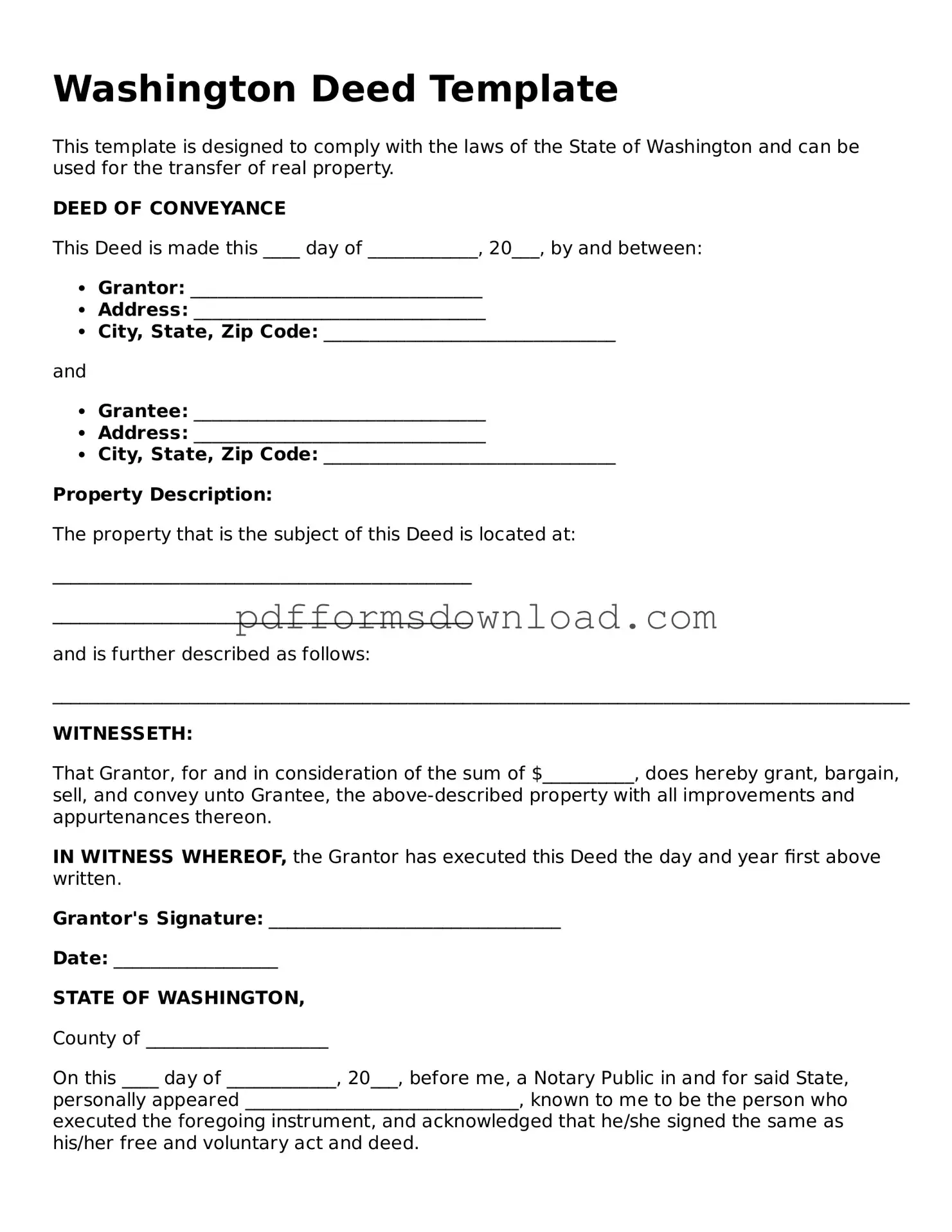

What is a Washington Deed form?

A Washington Deed form is a legal document used to transfer ownership of real property in the state of Washington. This form outlines the details of the transaction, including the names of the parties involved, the legal description of the property, and any conditions or covenants that may apply. It serves as a public record of the change in ownership and is essential for ensuring that the transfer is recognized by local authorities.

Who needs to use a Washington Deed form?

Anyone involved in the sale or transfer of real estate in Washington should use a Washington Deed form. This includes sellers, buyers, and sometimes even lenders. Whether you are selling your home, gifting property to a family member, or transferring ownership to a trust, completing this form accurately is crucial for a smooth transaction.

What types of deeds are available in Washington?

Washington recognizes several types of deeds, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. A Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. Special Warranty Deeds offer limited warranties, typically covering only the time the seller owned the property. Each type serves different purposes, so it’s important to choose the right one based on your specific situation.

How do I complete a Washington Deed form?

Completing a Washington Deed form involves filling out the required information accurately. You will need to include the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a legal description of the property, and any relevant details regarding the transaction. After completing the form, both parties must sign it in the presence of a notary public. It’s also advisable to check with your local county recorder’s office for any specific requirements or additional documentation needed.

Where do I file a Washington Deed form?

After the Washington Deed form is completed and notarized, it must be filed with the county auditor or recorder’s office in the county where the property is located. Filing fees may apply, and it’s important to ensure that the deed is recorded promptly to protect your ownership rights. Once filed, the deed becomes part of the public record, providing legal proof of ownership.