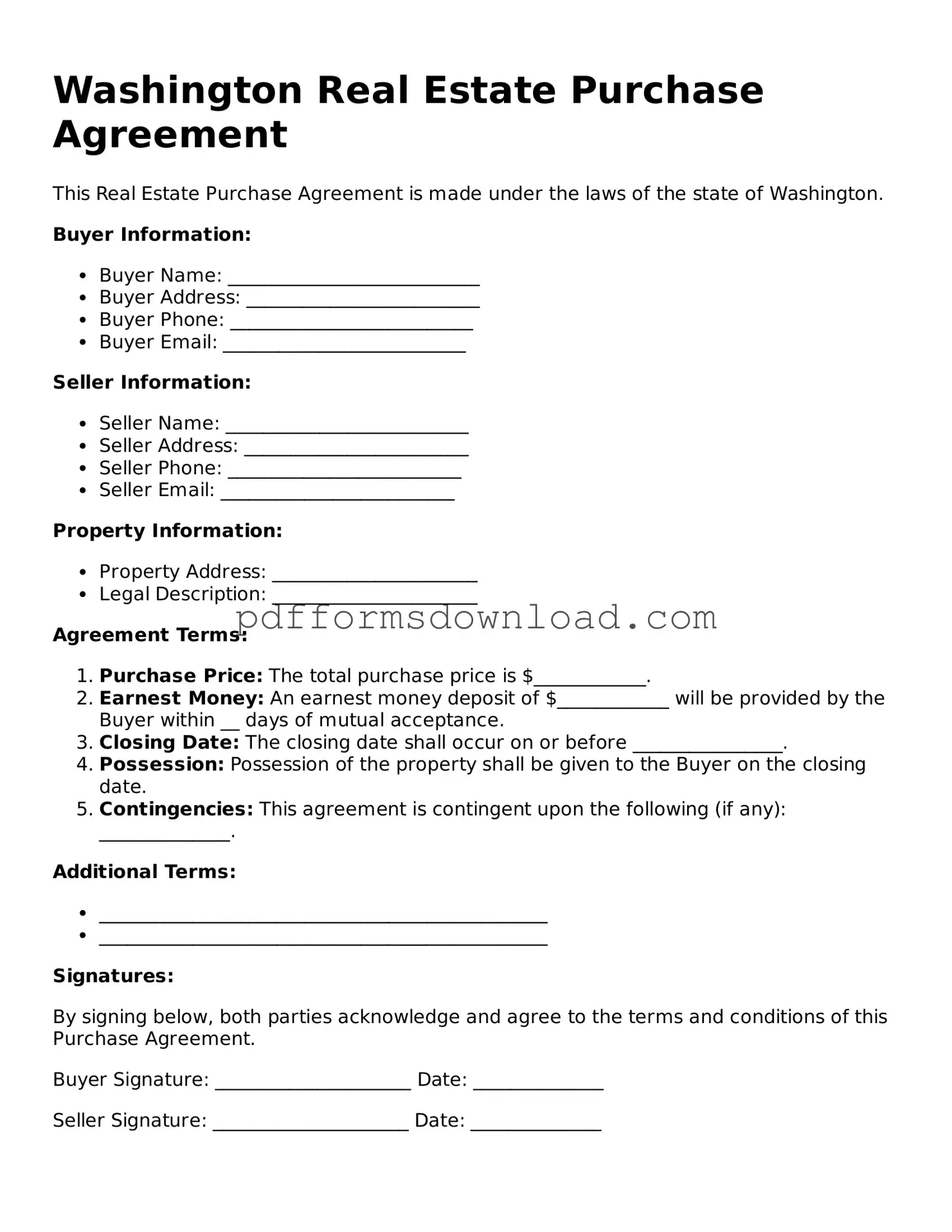

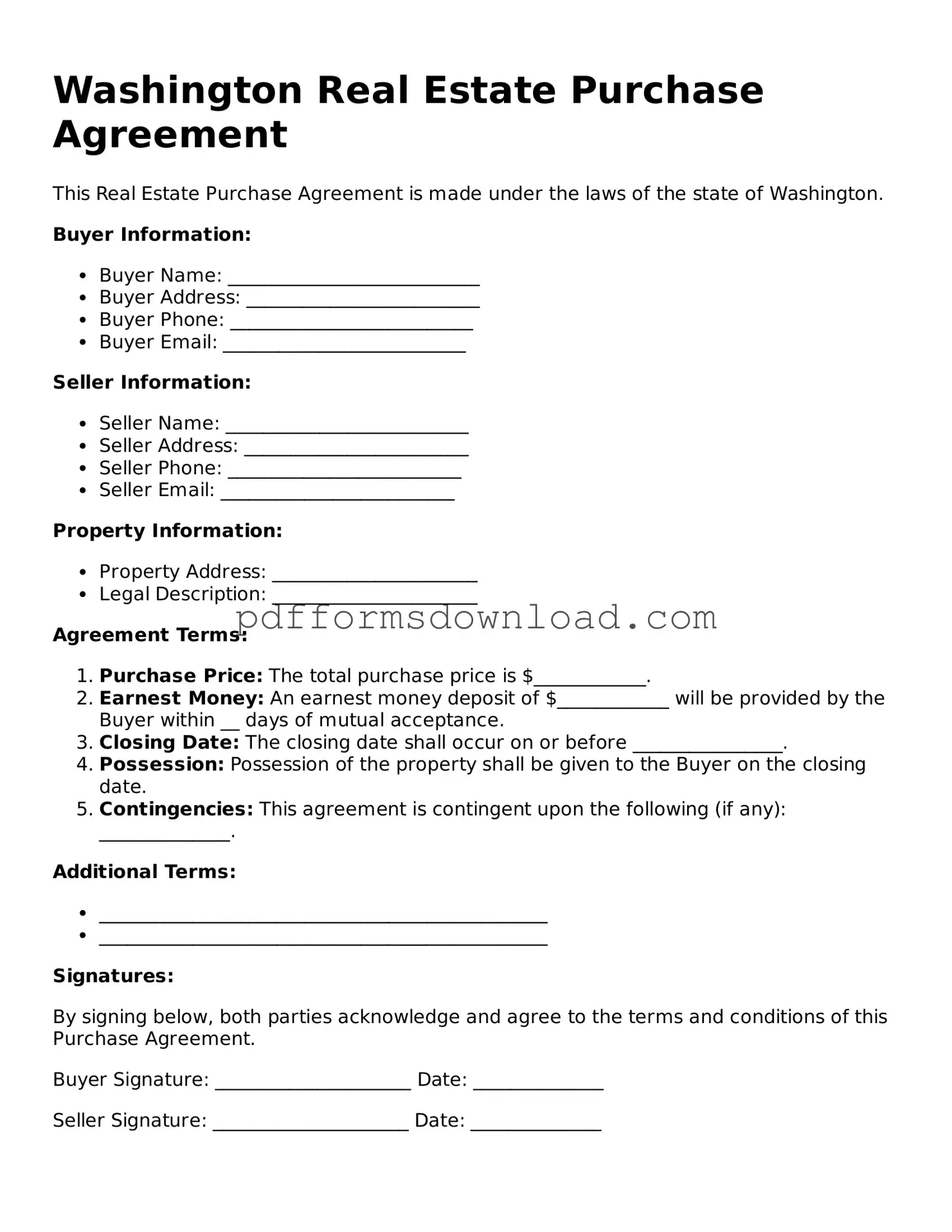

Printable Washington Real Estate Purchase Agreement Form

The Washington Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions of a property sale between a buyer and a seller. This essential agreement helps both parties understand their rights and responsibilities throughout the transaction process. For a seamless experience, consider filling out the form by clicking the button below.

Make This Document Now

Printable Washington Real Estate Purchase Agreement Form

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Real Estate Purchase Agreement online — edit, save, and download easily.