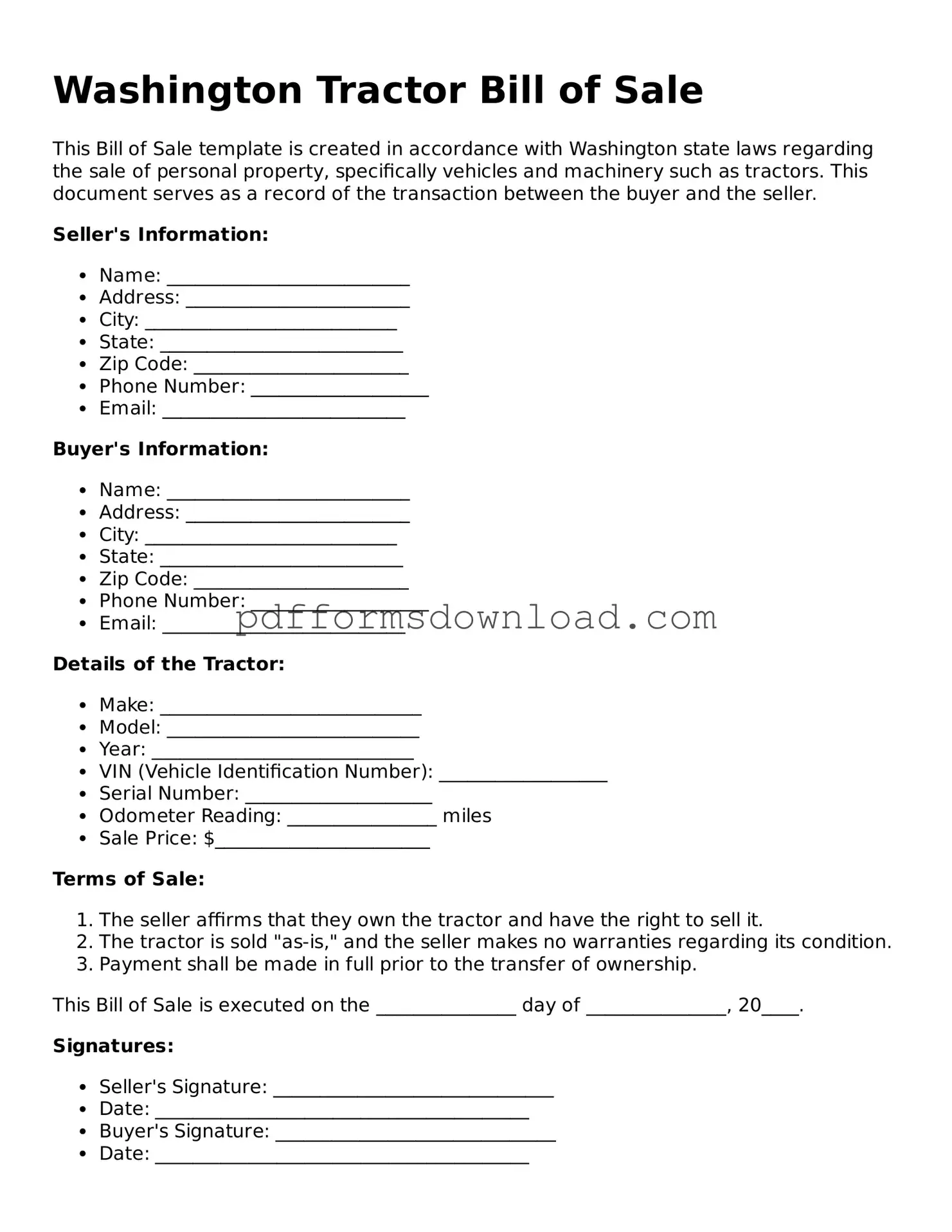

What is a Washington Tractor Bill of Sale form?

The Washington Tractor Bill of Sale form is a legal document used to record the sale and transfer of ownership of a tractor in the state of Washington. This form serves as proof of the transaction and includes essential details about the buyer, seller, and the tractor being sold. It helps protect both parties by providing a clear record of the sale.

Why is a Bill of Sale important for tractors?

A Bill of Sale is crucial for several reasons. Firstly, it establishes a clear transfer of ownership, which is important for both the buyer and seller. Secondly, it can be required for registration purposes with the Department of Licensing. Lastly, it provides legal protection in case of disputes regarding the sale or condition of the tractor.

What information should be included in the form?

The form should include the names and addresses of both the buyer and seller, the date of the sale, and a detailed description of the tractor. This description typically includes the make, model, year, Vehicle Identification Number (VIN), and any other relevant details. Additionally, it should outline the sale price and any terms related to the transaction.

Is the Bill of Sale required to register the tractor?

Yes, in Washington, a Bill of Sale is generally required to register a tractor with the Department of Licensing. It serves as proof of ownership and is necessary for the buyer to obtain a title in their name. Without this document, the registration process may be delayed or complicated.

Can I create my own Bill of Sale, or do I need a specific form?

You can create your own Bill of Sale as long as it includes all necessary information. However, using a standardized form can simplify the process and ensure that you don’t miss any critical details. Many online resources provide templates specifically for Washington that you can fill out and customize to your needs.

Do I need to have the Bill of Sale notarized?

In Washington, notarization of the Bill of Sale is not required for the sale of a tractor. However, having it notarized can add an extra layer of security and authenticity to the document, which may be beneficial in case of any future disputes.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer should then take the Bill of Sale to the Department of Licensing to register the tractor and obtain a new title. It’s also advisable to ensure that any payment method used is secure and documented, such as a bank transfer or a cashier’s check.