What is a Transfer-on-Death Deed in Washington State?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real property to a beneficiary upon their death without the need for probate. This means that the property can pass directly to the designated person, simplifying the process and potentially reducing costs associated with estate administration. The deed must be properly executed and recorded with the county auditor where the property is located to be effective. It is important to note that the transfer occurs only upon the death of the property owner, and the owner retains full control of the property during their lifetime.

How do I create and file a Transfer-on-Death Deed in Washington?

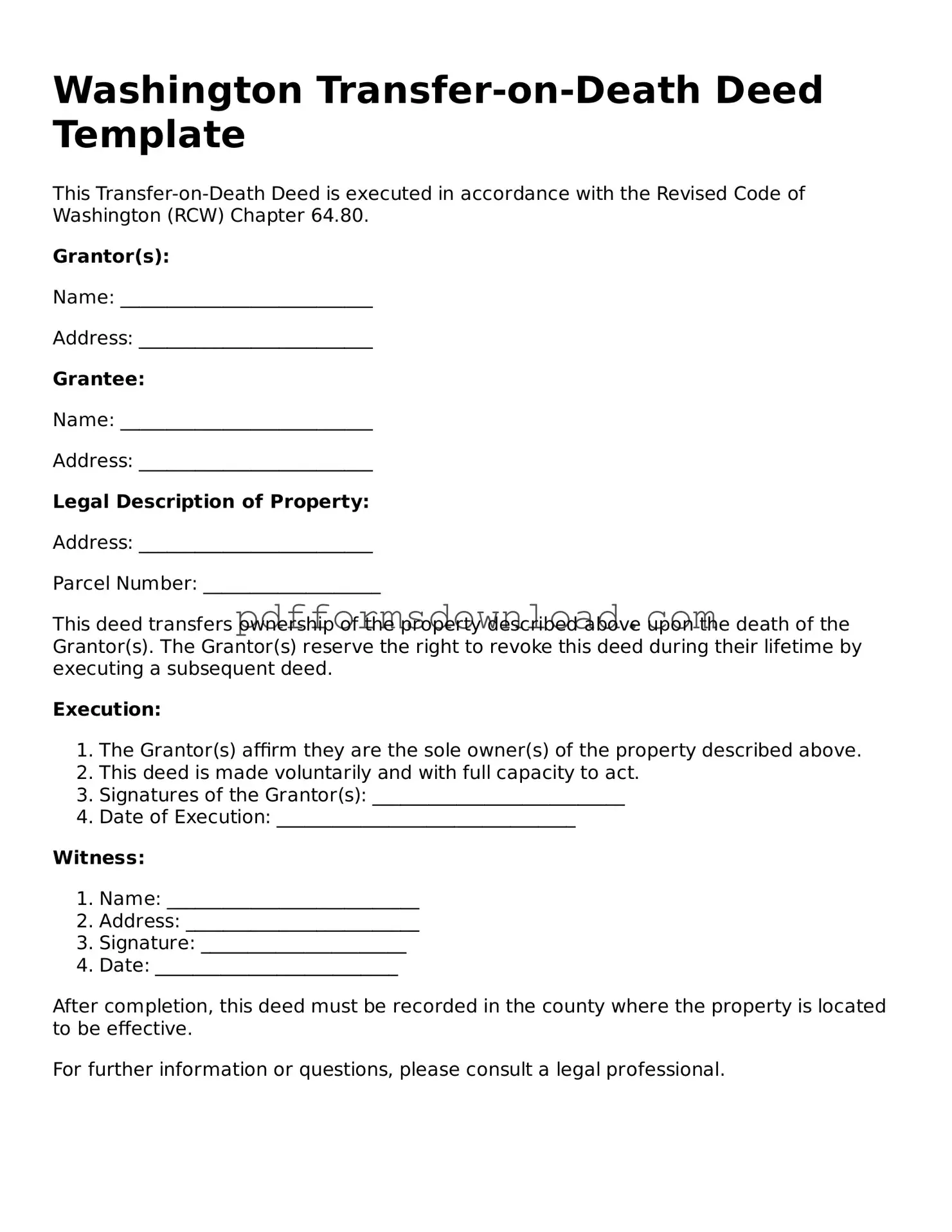

To create a Transfer-on-Death Deed, you must complete the form with accurate information about the property and the beneficiary. The form typically requires details such as the legal description of the property, the name of the owner, and the name of the beneficiary. After filling out the form, it must be signed in the presence of a notary public. Once notarized, the deed should be filed with the county auditor's office in the county where the property is located. There may be a small fee for filing. It is advisable to keep a copy of the filed deed for personal records.

Can I revoke a Transfer-on-Death Deed after it has been filed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the death of the property owner. To revoke the deed, the owner must execute a new deed that explicitly states the revocation or file a formal revocation form with the county auditor. The revocation must be recorded in the same county where the original deed was filed to ensure that it is legally effective. It is important to communicate any changes to the beneficiaries to avoid confusion in the future.

Are there any limitations or considerations when using a Transfer-on-Death Deed?

While a Transfer-on-Death Deed offers many benefits, there are some limitations and considerations to keep in mind. For instance, the property must be titled solely in the name of the owner at the time of death for the deed to be effective. Additionally, if the property owner has outstanding debts or liens against the property, these may still need to be addressed, as the transfer does not eliminate such obligations. It is also advisable to consider how the deed may affect tax implications for the beneficiary. Consulting with a legal professional can provide clarity on these issues and help ensure that the deed aligns with your overall estate planning goals.