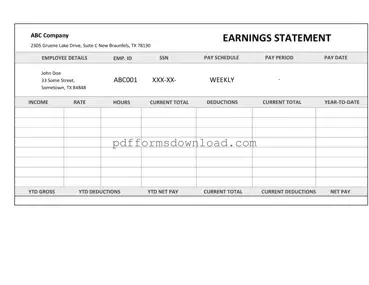

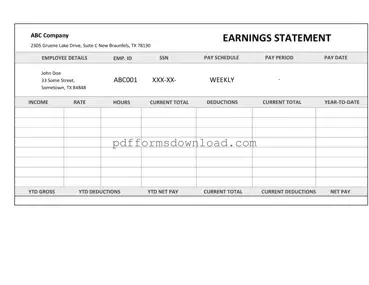

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. This form provides essential details about the work performed, payment received, and any applicable taxes or deductions. Understanding how to accurately fill...

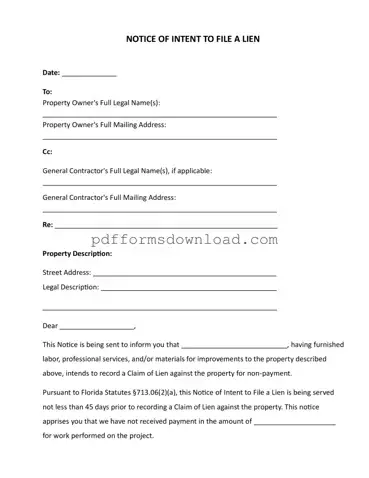

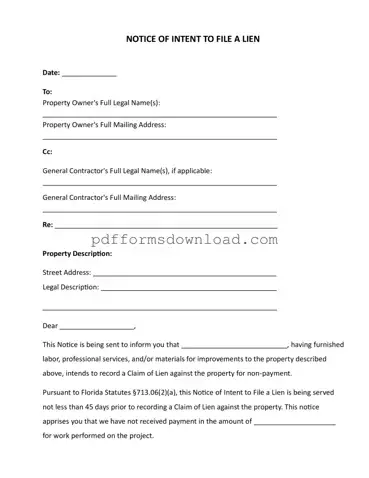

The Intent to Lien Florida form serves as a formal notification to property owners regarding the intention to file a lien due to non-payment for services or materials provided. This document is essential for contractors and suppliers, as it outlines...

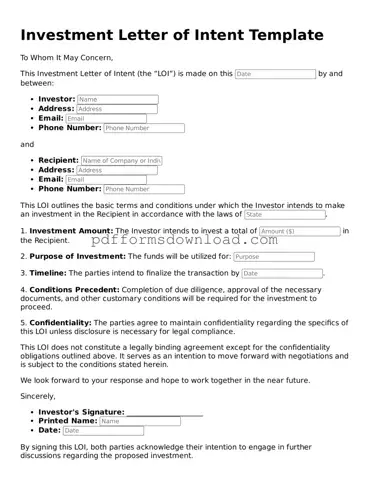

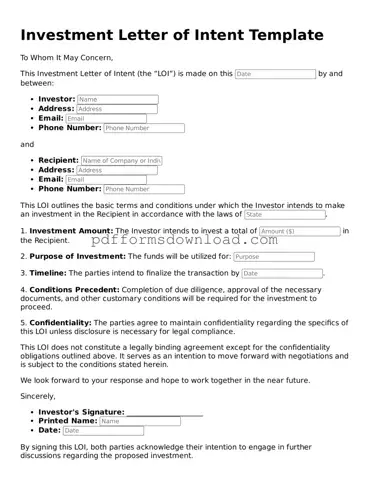

An Investment Letter of Intent is a document that outlines the preliminary understanding between parties regarding a potential investment. This form serves as a foundation for negotiations, detailing the key terms and intentions before a formal agreement is finalized. If...

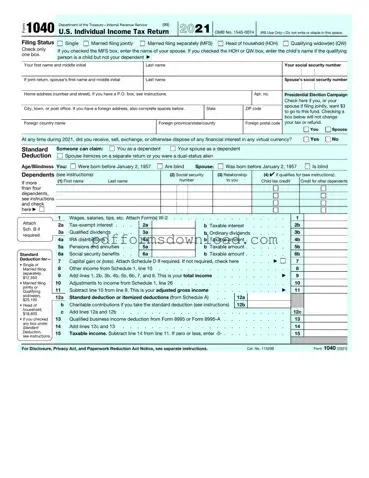

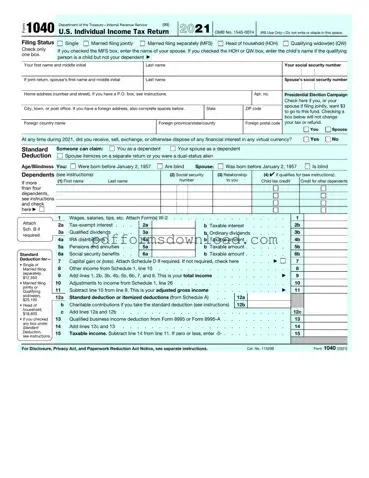

The IRS 1040 form is the standard document used by individuals to file their annual income tax returns in the United States. This form allows taxpayers to report their income, claim deductions, and calculate their tax liability or refund. Ready...

The IRS 1099-MISC form is a tax document used to report various types of income received by individuals who are not classified as employees. This form is essential for ensuring that all income is accurately reported to the Internal Revenue...

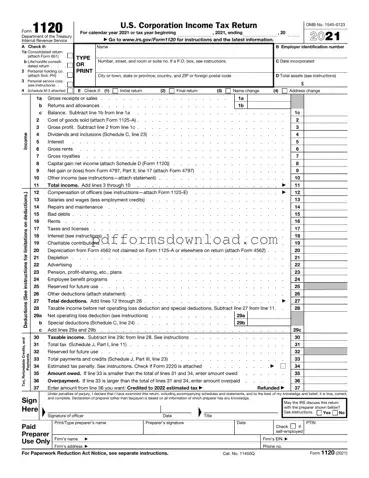

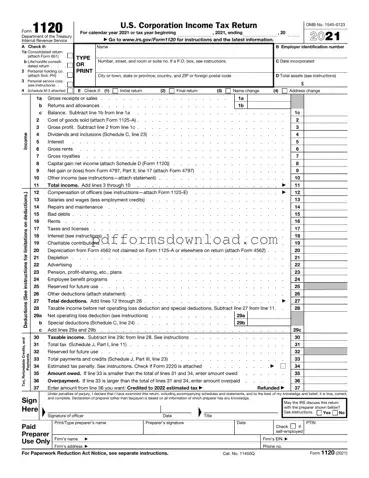

The IRS Form 1120 is a tax return used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form is essential for C corporations, as it outlines their financial performance and tax...

The IRS Form 2553 is a crucial document that allows eligible small businesses to elect S corporation status for tax purposes. This election can provide significant tax benefits, including avoiding double taxation on corporate income. Understanding how to fill out...

The IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is crucial for maintaining compliance with federal tax obligations and ensuring that...

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business activities. This form provides essential information about a business's earnings and expenses, helping to determine the net profit...

The IRS W-2 form is a crucial document that employers use to report an employee's annual wages and the taxes withheld from their paychecks. This form provides essential information for tax filing and helps ensure compliance with federal tax regulations....

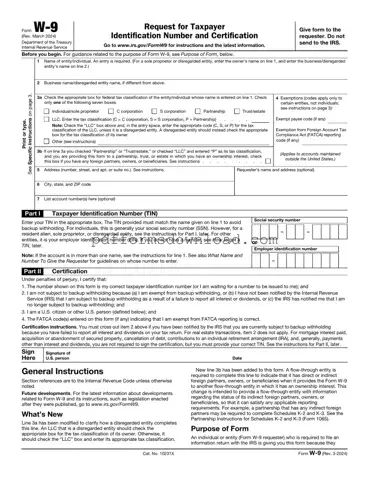

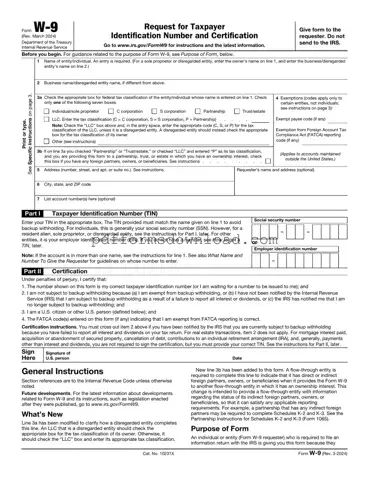

The IRS W-9 form is a crucial document used by individuals and businesses to provide their taxpayer identification information to the IRS. This form is essential for those who receive income that needs to be reported, ensuring compliance with tax...

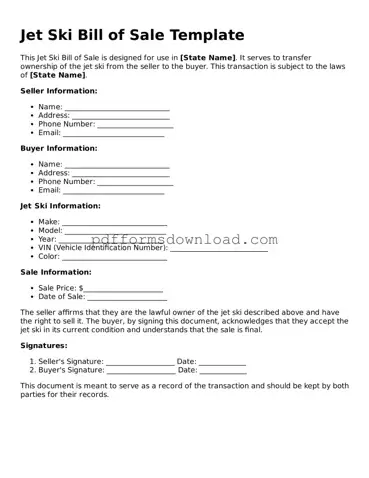

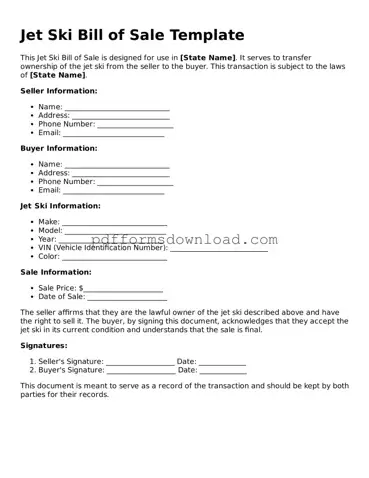

The Jet Ski Bill of Sale form is a crucial document used to record the sale and transfer of ownership of a jet ski. This form protects both the buyer and the seller by providing a clear record of the...